Activity 9e [Extension]: A brief history of the use of monetary policy

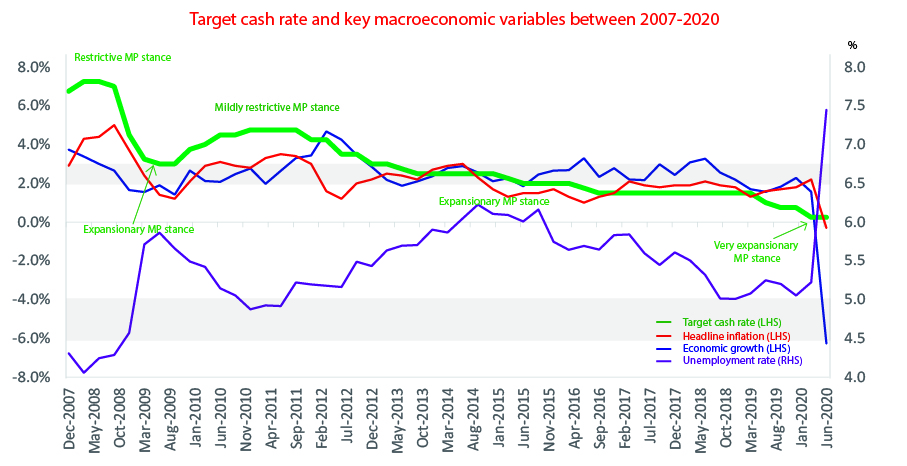

- Monetary policy was restrictive in the latter part of 2007 and 2009 given that the economy was experiencing excessive rates of growth (5%), combined with low rates of unemployment (approximately 4%) and a relatively high rate of inflation (5%). The RBA adopted this stance in order to reduce inflationary pressures such that inflation returned back towards the 2-3% range. The states became mildly restrictive once more in late 2010 as inflationary pressures were re emerging.

- This occurred because the economy was experiencing below trend rates of economic growth, the rate of unemployment was climbing and the rate of inflation started to fall below the 2-3% range. In this environment, the RBA stayed true to its charter and switched to its focus away from an attempt to reduce inflation and towards a focus on the promotion of full employment.

- As highlighted in the chart, the target cash rate remained at the same level of 1.5% between 2016 and 2018. Despite the fact that the cash rate did not move during this time, it does not mean that monetary policy was neutral during this period. Instead, monetary policy remained expansionary because, despite the lack of movement in the target cash rate, the cash rate remained at a low enough level to be stimulating the economy.

- This is because there were enough disinflationary forces working in the opposite direction, such as the impact of the drought, the possibility of a reduction in export demand due to deglobalization, relatively low wages growth and negative growth in mining investment.