Activity 5c: Economic implications of a changing NAIRU?

- NAIRU is an acronym for the non-accelerating inflation rate of unemployment and refers the lowest rate of unemployment that is achievable in the economy before wages and inflation begins to accelerate.

- At the end of 2022, the NAIRU was considered to be approximately 4.25%.

- If policy makers can accurately estimate the NAIRU (e.g. at 4.25% currently), Then any comparison between the NAIRU and the prevailing rate of unemployment in the economy will provide an indication of the degree of spare capacity in the economy. For example, if the unemployment rate was resting at 5% it suggests that there is spare capacity in labour markets [exerting downward pressure on wages growth]. However, if the unemployment rate was resting at 3% it suggests that there is zero spare capacity in labour markets [exerting upward pressure on wages growth].

- NAIRU estimates are likely to have decreased over time because of structural changes to the nature of the labour force, such as list secure forms of employment (e.g. those working in the digital economy as well as the higher numbers of people on casual employment contracts) and the declining power of trade union. Importantly, it is clear that the rate of unemployment is currently a less reliable indicator of spare capacity in labour markets compared to previous decades owing to the fact that there has been a growth in part time/casual labour and a resulting rise in underemployment.

- The Phillips curve describe the (short run) trade-off between the unemployment rate and wages/inflation. It highlights that any reduction in the rate of unemployment over time will typically be associated with an increase in the rate of inflation and any reduction in the rate of inflation will typically be associated with and increase in the unemployment rate.

6. A typical Phillips curve diagram is shown to the right.

7. It is possible for the Phillips curve to fall below the horizontal axis. This would indicate that there is significant spare capacity in the economy, with high rates of unemployment accompanied by deflation (i.e. the right of growth in prices is negative). This is precisely what happened in Australia during the COVID-19 induced recession of 2020.

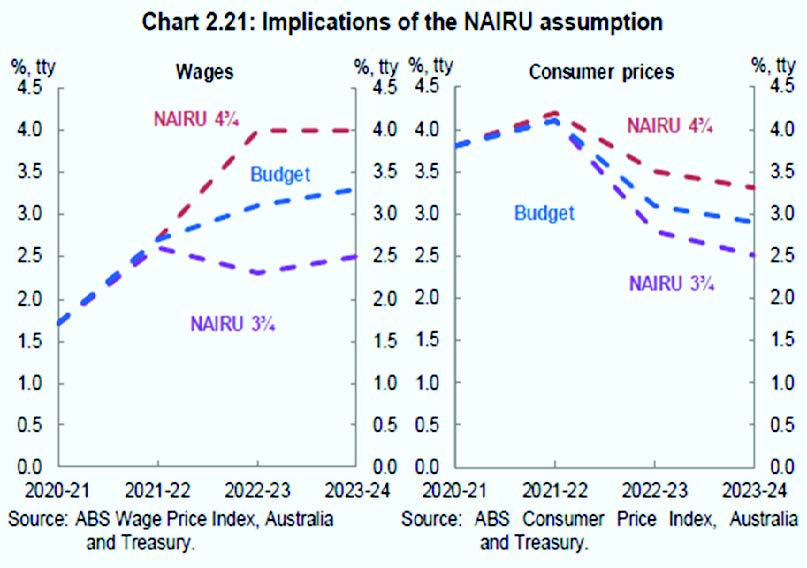

8. A low NAIRU assumption of 3.75% would cause the forecasts for both wages and prices to be lower than if the assumption for NAIRU was 4.25%. This is because actual rates of unemployment in the near term are more likely to be consistent with spare capacity in labour markets, which helps to contain wage and price pressures.

9. Any attempts by the government to achieve an unemployment rate that is below NAIRU is likely to result in upward pressure on wages and prices, leading to an acceleration in the rate of inflation. In the short run at least, it highlights that the government can exploit the nature of the trade off, accepting a higher rate of inflation in order to achieve a lower rate of unemployment. however, over the longer term, it is less likely that the trade off will hold. What tends to happen is that workers become conditioned to higher wages (growth) and factor these into wage demands and firms pass these on to consumers via higher prices, which reduces growth in AD, real GDP and the demand for labour, leading to unemployment rate returning to the NAIRU level.

10. If NAIRU is overestimated (e.g. estimated at 4.25% when it really resides at 3.75%) then policy makers [such as the RBA] are likely to incorrectly believe that there exists zero spare capacity in labour markets and the economy more generally. They are therefore more likely to prematurely adopt restrictive policies, which reduces the rate of economic growth and increases the rate of unemployment, making it more difficult to achieve full employment.

11. If NAIRU is underestimated (e.g. estimated at 4.25% when it really resides at 5%) then policy makers are likely to incorrectly believe that there exists spare capacity in labour markets and the economy. They are therefore likely to prematurely adopt more expansionary policies, which increases the rate of economic growth, reduces the rate of unemployment below NAIRU, causing an acceleration of inflation and making it more difficult to achieve price stability.