Activity 3g:

Sugar and tobacco – negatitive externalities and asymmetric information

- A negative consumption externality occurs when consumption of a good or service by a person imposes a cost on a third party. In contrast, production externalities are associated with the making of a good or service that imposes a cost on a third party. The difference is clearly associated with the type of activity involved; making or using the product.

- Consumption: If a person consumes tobacco in a public space, then those who are nearby may be subject to passive smoking. This means that they are breathing in poison which could make them sick and cause them to have to pay for doctor’s bills in the future. Production: The factories that produce the cigarettes might pollute nearby residents and/or cause the locval environment to suffer. Those who make a living from nearby rivers might experience a decrease in their production activities as a result.

- If sugar is consumed in the current period, then negative externalities may be imposed in the future: increased incidence of preventable diseases such as diabetes and obesity will mean that more tax revenue will be needed to treat the patients. This means that all those in society might be forced to experience the costs (via higher taxes). In addition, workplaces might become less productive in the future due to increased numbers of sick days and reduced cognitive function caused by excessive sugar consumption.

- The industries in the case study tried to confuse the public about the consequences of consuming their products by paying scientists to prepare studies that cast doubt on other, more independent studies. The sugar industry tried to demonise fat and this led to, what some might argue to be, the misleading health guidelines.

- The lack of knowledge about the damage caused by sugar may have led to a significant increase in diabetes and obesity. This means excessive resources have been allocated to health conditions that could have been avoided. The intake of sugar may also have been associated with a reduction in technical efficiency because more days are lost to illness and the consumption of sugar may have reduced the cognitive function of people over time.

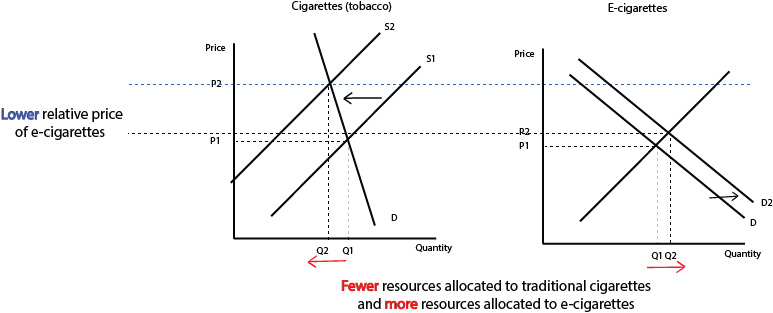

- An excise tax raises the cost of production and shifts the supply curve to the left. This causes a shortage at the existing price and the price is bid up. As the (relative) price increases, demand should contract due to the substitution and income effects and fewer resources will be allocated towards the production and consumption of the product (e.g. cigarettes) and more resources are allocated to the production of alternative (substitute) products.

7.

8. A number of policies can be introduced to shift the demand curve to the left:

Education campaigns which are designed to reduce asymmetric information and cause there to be a change in tastes and preferences

- Choice architecture – this is where certain products are deliberately placed away from sight so that there is less chance of people buying them impulsively

- Subsidising non-sugary products would reduce the price of a substitute and may help to shift the supply curve to the left.

- Health star ratings and nutritional information on packages might help to reduce asymmetric information and help tchange tastes and preferences.