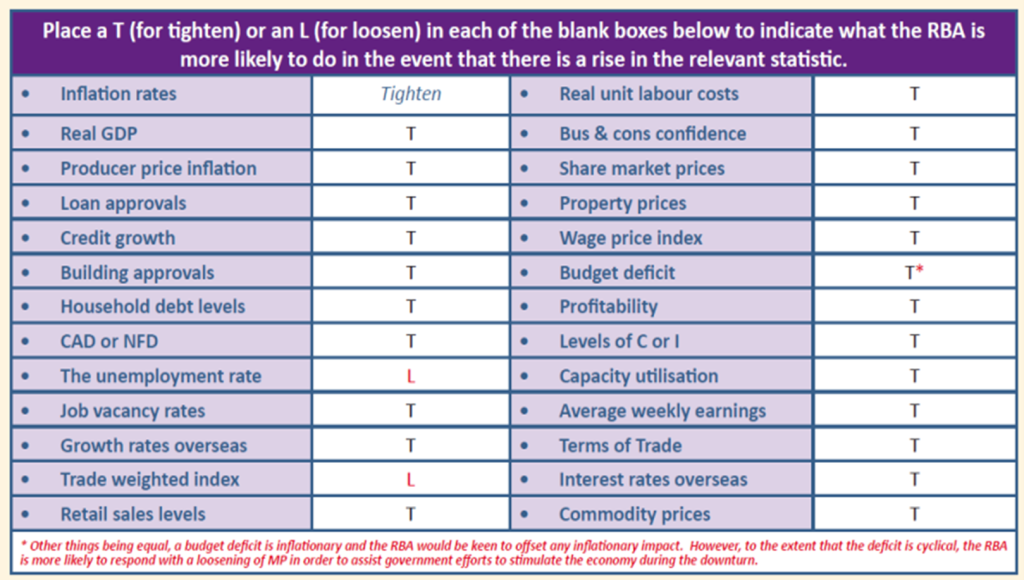

Activity 9e Influences on monetary policy settings

- Growth in the rate of real GDP to unsustainable levels is most likely to cause the RBA to make monetary policy less expansionary or more restrictive via a tightening of policy and an increase in the target cash rate.

- Higher producer prices (e.g. the prices for raw materials or equipment) will create cost-inflationary pressures and therefore result in the RBA being more likely to tighten monetary policy to reduce ‘inflationary’ pressures in the economy. [The extent to which the RBA tightens policy in the face of cost-inflationary pressures will ultimately depend on the underlying strength of the economy.]

- Falling asset prices are likely to reduce consumer demand (via the wealth effect) and contribute to a reduction in demand inflationary pressures. Other things being equal, the RBA is more likely to loosen monetary policy given that inflation becomes less of a concern and the RBA will be freer to focus on growth and jobs.

- A smaller structural budget deficit implies that the government is adopting a less expansionary policy stance. This should help reduce inflationary pressures in the economy and, therefore, enable the RBA to implement a more expansionary monetary policy setting (or less restrictive one) than would otherwise be the case.

- A tighter labour market is reflected by strong growth in the demand for labour relative to the supply of labour. This should help to reduce the rate of unemployment as businesses take on more workers, and, at the same time, increase job vacancy rates as firms will find it increasingly difficult to fill positions at workplaces. As a consequence of the relatively strong demand for labour, wage growth is likely to increase, exerting upward pressure on both nominal and real unit labour costs, which in turn will increase production costs and inflation.

- Lower capacity utilisation rates mean that there is more spare capacity in the economy, which exerts downward pressure on prices and inflation. The RBA is therefore more likely to shift its attention away from inflation and towards economic growth and jobs by implementing a more expansionary or less restrictive monetary policy setting.

- A lower TWI effectively means that the exchange rate depreciates, which increases inflation (on both the demand and supply sides) and therefore makes it more likely that the RBA will adopt a less expansionary or more restrictive monetary policy setting by tightening policy and thus increasing the target cash rate to reduce inflationary pressures.

- Slower growth in China is likely to negatively impact the rate of growth in Australia, which exerts downward pressure on prices and inflation and therefore makes it more likely that the RBA will adopt a more expansionary or less restrictive monetary policy setting by loosening policy and decreasing the target cash rate.