Activity 6d:

Recovery in real household disposable income

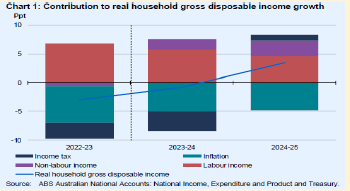

- The main factors influencing real household disposable income include income earned from employment (i.e., labour income/wages), non-labour income (e.g., interest, rent, dividend income), personal income tax (which reduces households ‘disposable income), and the rate of inflation (which reduces household disposable income’s purchasing power).

- The rise in real household disposable income over 2024-25 is due primarily to growth in non-labour income as well as the reduction in tax rates. It was also contributed to by the rise nominal wages/labour income (which, of course was mostly offset by the rise in inflation).

- Inflation had a negative impact on real household disposable income over the three years covered by the table, however, at a declining rate. The high rate of inflation (above 7%) over 2022- 23 was significantly impactful, so much so that it resulted in a fall in real wages despite the relatively large rise in labour income.

- Nominal wages refer to actual income received from labour and its command over goods and services (i.e. its ability to purchase goods and services) before taking into account the effects of inflation. In contrast, real wages adjust nominal wages for the effects of inflation and provide a more accurate measure of labour income command over goods and services. Factors contributing to growth in nominal wages relate to the underlying forces of demand and supply in labour markets. With very low rates of unemployment indicating excess demand for labour, it creates upward pressure on (nominal wages). The excess demand for labour has occurred because of strong growth in the underlying demand for labour as the economy recovered from the recession, as well as the relative fall in the supply of labour partly due to a decrease in immigration.

- The government can, and has, delivered cost-of-living initiatives (e.g. energy and rent subsidies) that are specifically designed to boost the purchasing power of households in an effort to ease the cost of living pressures on households.

- The improvement in disposable income is likely to increase aggregate demand and economic growth, which in turn assists with the achievement of a strong rate of economic growth, as well as helps to maintain downward pressure on the rate of unemployment that is consistent with the government’s full employment goal. However, it is likely to increase pressure on prices and, therefore, make it more difficult to achieve the goal of price stability.